We receive a lot of messages asking when the next housing market crash will be. While wanting to know when a property crash will happen is completely understandable, not everyone is necessarily waiting for the right reasons, and it could cost them in the long run.

In this article we’ll cover:

- Why people are tempted to wait for a housing market crash

- When the next housing market crash will happen

- What would actually happen if you invested at the worst possible time

- How to survive a housing market crash

And if that’s not enough, we’ve got loads of extra resources for further reading, watching, listening and even playing.

Why are investors tempted to wait for a housing market crash?

People want to invest after a crash because that’s when prices are lowest, and nobody wants to buy a property right before prices drop. But is that really when prices are at their lowest?

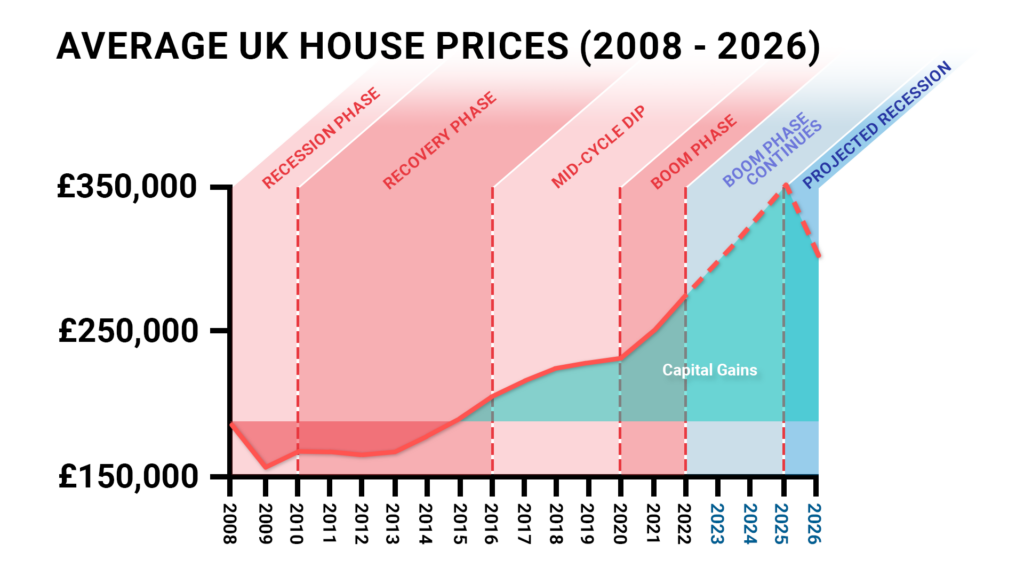

If you look back at 2008, average UK house prices dropped 15% from £185k to £155k. This is certainly dramatic, but in 2000 the average UK house price was £84k. Indeed, if you’d brought any time before May 2005, you’d have bought the average house for less than what the prices crashed to in 2008.

A crash is a big event. It has a huge impact on our lives and the news cycle. But as a result of this impact, we tend to over-estimate just how dramatically house prices actually fall by. If we’re more than two years from a crash, you’d almost always be better off buying now than waiting for a crash.

Of course, we’re using UK averages here. Different areas ride out crashes in different ways. Over-inflated areas can be hit much harder by a crash. Some areas will recover quicker than others. And in the UK London generally reacts differently to other parts of the country.

A big driver behind people ‘waiting for a crash’ is that they’ve got interested in property ‘too late’. There’s a huge increase in media attention during the boom phase when prices start to go wild. This means people suddenly feel lots of pressure to invest when it feels like there’s lots of money to be made.

But prices increase faster than people can save, deals get snapped up quickly and it’s very hard to jump in as the average person. As a result of this, people who feel excluded believe that a correction feels inevitable, or even wanted.

But a crash isn’t the magic bullet that people think it will be, crashes almost never drop prices to ‘affordable’ and they have a lot of knock-on effects that actually make buying in even harder for the average person.

Will there be a housing market crash?

Does property even have to crash?

Well, no. But it’s fair to assume it will because nothing has fundamentally changed since 2008. There are a few more rules, and mortgages are a bit harder to get than in the 2000s, but there’s still a house building deficit, property prices still rise higher than inflation and we all need somewhere to live.

Most importantly, while the 18-year property cycle is a product of economic market forces it’s also partially driven by human nature. No matter how well informed we are, we’re all susceptible to the fear of missing out when prices seem to be going higher and higher, and we all think we can outsmart the market and time it perfectly.

Even if we’re personally disciplined enough not to fall into the traps of the cycle, enough other people moving in the same direction will over inflate prices. This leads to a bubble which must be followed by a crash.

There’s also another reason it’s interesting that the cycle is 18 years. That’s roughly how long it would take a new crop of first-time buyers to reach the age to buy with no first-hand experience of the previous crash – and therefore be naïve to the lessons of recent history. The average age of a first-time buyer in the UK is 34. This means just before 2008, first time buyers were 16 years old – and it’s unlikely they were paying close attention to the property market.

This means even if we started building enough houses and there were sufficient protections in place on mortgages, we’d still struggle to control a boom/crash property cycle because there’s a constant wave of new buyers who don’t know to look out for the signs of a housing market bubble.

What is the ‘winner’s curse’ phase in the 18-year property cycle?

You might have heard people talking about the ‘winner’s curse’ when it comes to the 18-year property cycle.

The winner’s curse is a term from auction theory that was observed in 1971 by E.C. Capen, R.V. Clapp and W.M. Campbell in their paper ‘Competitive Bidding in High-Risk Situations’ studying oil buying.

The winner’s curse is a phenomenon that may occur in common value auctions, where the winner is the bidder with the most optimistic evaluation of the asset and therefore will tend to overestimate and overpay.

In simple terms, if you sell something at auction the winner almost always overpays because they kept bidding after other bidders stopped when they felt the item was being sold for more than it’s worth. Most property isn’t sold by auction of course, it’s sold by a buyer negotiating indirectly with a seller.

Normally in property you’re able to put in an offer of what you think a property is worth based on your research. This means prices are less likely to be driven up by competition. But during a boom phase multiple sellers will often put in offers for a single property, starting bidding wars and creating a quasi-auction.

The winner’s curse in property is generally used to describe when someone buys during the boom phase only to find after the crash that their property has fallen below what they paid for it. Generally, this happens if you buy two years before a crash. Although, price falls in a crash are not uniform, so some areas it could be much more than two years, others it could be much less. Similarly the amount of time it takes for the market to recover can differ depending on where you bought and just how much you overpaid by.

We’re not just academically aware of the winner’s curse phenomenon, it actually happened to Property Hub CEO Rob Bence, which is a story we’ll share later in this article.

What happens if you buy property right before a crash?

January 2008 was the worst time you could’ve bought property in recent memory. That was the high point for property prices, just before the property market crashed globally.

The average UK house price was £185,000.

One year later in January 2009 the average had fallen to £157,000, a punishing 15% fall.

If you’d bought with leverage that loss was multiplied by 3, giving you a –45% ROI.

In 2022 you’re likely buying with a 75% LTV, which is standard at the time of writing, meaning leveraged losses and gains are multiplied by 3. However, in 2008 you could have bought with a far more extreme mortgage product with far less stress tests from the banks – making losses more likely and more extreme. This is one of the signs of a crash – cheap and risky credit is normalised.

So, presuming you weren’t forced to sell in January 2009 and lock-in those losses, what would happen if you’d managed to hold onto the worst property investment in recent memory?

Ten years later (we told you we’re investing for the long term) in January 2018 it would be worth £224,000.

Giving you a total growth of £39,000 over ten years.

In percentage terms that’s 21%. A not overly exciting 2.1% per year.

But if you bought with leverage, you can multiply your ROI by 3 giving you 63% overall and annualised capital-only ROI of 6.3% – well over inflation across this whole period.

6.3% isn’t bad for the worst timed investment you could have made across that whole decade.

But what if you held until now, 2022? In 2021 house prices rose 10% making the new average UK house price in January 2022 £274,000. So, you’re £89,000 ahead of your 2008 purchase price. An ROI of 48%, and an annualised ROI (if you used leverage) of 9.6%. Suddenly this investment isn’t looking too bad, even though it’s the worst timed you could manage.

We can take this example even further. What would happen if you kept holding this property through the next crash?

There hasn’t been another crash since 2008 but we can model out into the future. If we take the possible time of the crash as 2026 and put annual growth between now and then at 8% (which is being conservative considering a boom comes before a crash), then here’s the prices we’re looking at;

- January 2022 – £274,000

- January 2023 – £295,900

- January 2024 – £319,500

- January 2025 – £345,160

- January 2026 – £372,770

So you peak at £372,770 before the hypothetical market crash in 2026.

Even if we say prices drop 20% in the next crash (which is extreme considering 2008 saw prices fall 15% in the UK) you’d end up with a value of £298,200 – significantly more than when you bought for £185,000 in January 2008.

This gives you capital gains of £113,200 over 18 years which is 61%, or 3% annualised ROI.

3% annual ROI might not sound earth-shattering, but we’ve taken the worst possible time to buy, been very conservative in modelling growth from 2022 onwards – and then added a more brutal crash than 2008.

Also don’t forget, if you bought with leverage then you can multiply your ROI by 3, so that 3% becomes 9% – which seems much healthier for the worst possible purchase through not one but two crashes.

And finally, this is just capital gains. You’d also have had 18 years of rental income throughout this period.

This also demonstrates one of the principles of the 18-year property cycle, which is that prices never fall lower than where they started. As we can see from this example a fictionalised 2026 crash wouldn’t cause prices to drop back to even the peak of January 2008.

We’ll stop the simulation there, but we know from the 18-year property cycle that the value of this property would eventually recover after the crash.

This isn’t just academic, this actually happened to The Property Podcast’s very own Rob Bence on his first purchase.

Here’s Rob’s experience of buying at the peak of the market and suffering the full force of the winner’s curse.

One of the first mistakes I made in property was buying at the peak of the market. Back in around 2006-07 I purchased my first property. Wow was the timing good; the market was on the rise. I was on to a good thing.

Well, it turned out in the not-too-distant future I was massively wrong. The property I purchased was now worth less than the mortgage I had on the property, so I was now in negative equity. For somebody new to the property world that was a scary proposition.

In hindsight, while it was still a mistake, I don’t regret the mistake. I’m glad I made that mistake it because I still own that property. Even though it took a decade to be worth what I paid for it again. During that whole period of time it paid me to own it.

When will the housing market crash?

Knowing when the crash will happen is important to avoid the winner’s curse – so naturally people want to know when it’ll take place. If we look at the 18-year property cycle then some simple maths says 2008+18 = 2026.

However, the thing that makes dating a crash complicated is the start point is hard to define and the length of the cycle can be 18 years, and any number of months. Take the beginning… when did the housing market crash in 2008? Can you point to an exact date? Not really. Even if you could, the 18-year property cycle isn’t the ‘exactly 18-year property cycle’. As you’d expect from any huge market force playing out over almost two decades across millions of purchases – it’s not an exact science.

There’s also a pandemic that lots of people thought might cause a crash – but didn’t. Although just because it didn’t cause a crash doesn’t mean the pandemic didn’t drop pebbles into the pond whose ripples may still have unexpected consequences into the future.

The final factor is human. We’re pesky animals, sometimes we move in herds following predictable patterns, sometimes we do the unexpected or get spooked by something that in hindsight was irrational. Markets are moved by people, or increasingly by algorithms coded by people.

That said, everything we’ve seen points to 2026-2027 as a likely period for a housing market crash.

Ironically if we perfectly predicted a housing market crash and got the message to enough people then that would technically be able to warp the market and potentially even move the crash. Just one of the many factors that stops investing (and doing a weekly podcast about it) becoming boring.

What are the signs of a housing market crash?

When a crash happens, it’ll probably happen quite quickly and be widely reported. Ironically the news reports about it will contribute to how quickly it happens.

Rather than looking for signs of a crash, which will almost certainly happen too quickly to react to as an investor, it’s much easier to look for signs of the boom phase that precedes a housing market crash.

Here’s what you can expect in the boom phase:

– Property will be everywhere, in every medium – but most noticeably TV shows. Homes Under The Hammer never went away, but there’ll be more joining it.

– Overseas property sales heating up. As people realise the money you can make from property but get complacent with UK growth they start to look further afield where promised returns are even higher (The key word there is promised).

– Foreign investment in the UK. This is the reverse of the previous point, as the UK market starts to boom overseas investors will take note and start to compete for properties here.

– Courses. Yes, we know Property Hub has courses, but ours are free, as is our podcast and this article you’re reading right now. The sort of courses that indicate a boom phase are ones you pay for, and will usually promise to change your life. Whereas hopefully you’ll find Property Hub’s education grounded in reality, much more useful and most importantly – free.

– A tallest building announcement. Both the Shard and Burj Khalifa were conceived during the boom phase before the 2008 crash. They completed after the crash, but the initial excitement and funding was driven by the boom.

– Articles about how much money your property is making, headlines like ‘Your property is making more money than you’ and ‘This is how much your property is making a day’ will pop up over and over.

– Lots more mortgage products will hit the market. The competition will drive better Loan-To-Values, even on your own property. There are 95% LTV at the moment, but not very many products offer this, but we’ll see more and more of this pop up. This will hopefully make it easier for first-time buyers.

– Limited company lending will improve. Alongside lending to consumers, lending for companies will increase and more favourable rates will be introduced as more and more people are investing in property.

– Suddenly everyone is a property ‘expert’. Not just hucksters pushing property courses that’ll ‘change your life’ but suddenly everyone you know is an expert. Property will be mentioned in normal conversations between friends as everyone realises the boom is happening (even if they don’t know to call it a boom).

– You’ll start seeing properties going way over asking, sometimes without even being viewed. Not necessarily investors, just homeowners caught up in the hysteria.

Is timing the property market possible?

Of course, but if you’re honest with yourself it’s almost certainly more luck than judgement. Markets are complicated and buying property takes time, making it almost impossible to deliberately time a purchase or a refinance perfectly.

Knowing the 18-year property cycle can help you avoid the winner’s curse and predict a crash, but it’s still no guarantee.

Maybe a better approach is not even trying to time the market because on a long enough timeline property is always a strong investment:

If you’re in it for the long term, get in now. Because yes, you might be able to time it at a slightly better period but if you don’t, you’ve missed out on all the growth that’s available right now.

As we’ve seen earlier, even if you time the market terribly and make the worst timed purchase right before a crash and then hold until the worst possible time, right after the next crash, you’d still probably make money. You might not be able to time the market, but that can always be overcome by time in the market.

The hidden risk of waiting for a housing market crash

If you’re not convinced by everything we’ve written and you’re still waiting for a crash to buy bargain property, then we’ve one final appeal for you.

Waiting to buy when prices are low, and your money will go further makes intuitive sense. If you ignore everything we’ve written above of course.

But how are you going to buy if banks aren’t lending? If you’re a cash buyer you’re in a strong position, but most buyers will be relying on leverage to buy.

Property crashes don’t just make prices lower – they make banks reluctant to lend, they make governments bring in new rules and they make the job market very challenging. You may be sitting on a deposit waiting for a crash and feeling rather smug. But if you wait to buy, then a crash makes your job insecure, you might not be able to get a mortgage and may not even want to buy when your main income is threatened.

Whereas, if you’d bought before a crash you may still have job insecurity afterwards – but you’d have a trickle of rental income to help you weather the uncertainty.

Alternatively, you may have the deposit in hand and your job feels solid, but banks don’t want to risk a buy-to-let mortgage on someone without a track record as a landlord. Meaning you may end up paying higher rates, eating into the savings from a lower buy price. Or you can’t buy at all for a few years until the market stabilises and lenders feel more confident.

It’s very hard to predict what the landscape will be like after a crash. Planning for a crash is a very risky prospect because it’s almost impossible to factor in how banks, governments and sellers will react.

We think we’re good at predicting, but we’re often wrong. Remember at the start of the pandemic when a ‘baby boom’ was widely predicted as we were all ‘bored at home together’. This was repeated so many times during those first few months that many people didn’t even follow up on it. But birth rates actually fell during 2020 – the exact opposite of the received wisdom and widely reported prediction.

How to survive a housing market crash

Rob & Rob did a podcast on how to survive a property crash quite early on in the life of The Property Podcast (skip to 5.40 to get into the detail).

A very basic way you can give yourself more runway during a downturn is interest only mortgages. This makes your repayments lower than capital repayment mortgages. You can overpay when times are good and pull your payments right back to the interest only during a downturn. This flexibility gives you more options to react.

The most important way to get through a crash is avoid being forced to sell a property when prices are low. One way that investors are forced to sell is if interest rates spike, making mortgages unaffordable. This seems unlikely to happen again as they actually dropped after the 2008 crash. However, with interest rates at historically low levels it doesn’t give central banks many places to go other than up. There is also a tendency of governments to respond to a crash differently to how they responded to the last one, but central banks usually are more immune to this kind of thinking.

That said there are ways to plan for possible interest rate rises. Indeed Buy-to-let mortgages already include stress tests to make sure your rental will cover your mortgage even if interest rates rise. The current level is 145% of an assumed 5.5% annual rate.

So, if you borrow £100,000, your annual interest repayments at 5.5% would be £5,500. Monthly this would be £458.33. The 145% makes this £664.58. Meaning, if you borrow £100,000 you need to be able to get at least £665 in rent to be accepted for a mortgage.

This is the stress test you have to do, but there’s nothing to stop you running your own stress tests for peace of mind to make sure your portfolio is robust.

The best way to survive a crash is to avoid the mania of the winner’s curse. If you throw all in and stretch yourself to the limit because ‘everyone else is doing it’ you’re in for an extra big shock when the market corrects. If you put your deals through the same scrutiny and stress tests as you always have and resist the fear of missing out, you’ll be in a stronger position. This will be extremely hard because there are so many pressures telling you to invest.

This happened in 2008, the people who went crazy in 2006 and 2007 got badly hurt. Whereas the people who built slowly, and even rolled back during those years were largely able to weather the storm.

Another thing you can do before a crash (if you think a crash is coming) is refinance your properties and build up cash reserves. This will give you extra runway and security if things change rapidly, but also means you have cash on hand to snap up deals after a crash. Avoid the temptation to spend all that cash on flash cars and fancy holidays. Or else you’ll be in an extra awful position when property prices crash because you’ll have higher mortgage rates and no cash on hand.

Holding properties with a good yield will help you get through the crash too. That means you’ll have income to offset the uncertainty. The investors who got badly hurt in 2008 were people who bought income neutral or even income negative properties, counting on capital gains to provide profit for them. When this didn’t happen and interest rates changed, they were left holding a loss making property that they’d almost certainly be forced to sell at a loss.

Having cash in the bank is key for riding out a recession. If interest rates spike and mortgages go higher, or your tenants lose their jobs and you have a series of rental voids you might have sudden unexpected expenses – possibly on multiple properties simultaneously. This means you’re cashflow negative.

You need to be able to cover your mortgages somehow or else you’ll be forced to sell. This really is the worst time to sell as there aren’t many buyers so demand is low and there are lots of people in your position selling, meaning supply is high – which drives down prices.

If you bought during the winner’s curse there’s a chance that you might have to sell below your mortgage even, leaving you having to cover the balance.

However, if you’ve got cash in the bank and you go cashflow negative you can cover your expenses from your reserves. Nobody wants to do this of course, but it can avoid the even bigger expense of being forced to sell. Especially if you’re covering a clearly temporary situation like a rental void. It’s much easier to dip into your reserves to cover an expense with a clear end date.

Property is a long-term investment, if you can ride out a dip using your cash reserves without selling you can come out in a much stronger position than you went in.

If you can hold your reserves, don’t go cashflow negative, then you’re in a fantastic position to buy back in at cheaper prices and really make huge moves for the future.

The main thing about a crash, whether you believe in the 18-year property cycle or not, is that property crashes have happened before. This means we can study what happened before and make projections about what is likely to happen again.

One of our listeners has taken this principle to an incredible level and made a tool anyone can use. Ed Atkinson built this excellent tool for assessing how your portfolio would fair in the last five recessions. So, while we might not know exactly what will happen next, but you can see how you would survive right now if something from the past happened again. In Rob Dix own words, “this is a geeky spreadsheet. But an absolutely amazing one.”

Ultimately, waiting for a crash before purchasing might work for you in the short-term. But for those of us who want to be in this game for the long haul, then waiting for a crash could be very detrimental to the performance of your investment portfolio.

Start investing in property right now

If we’ve convinced you that it’s a good time to invest in property you can book a strategy meeting with one of our portfolio managers from the Property Hub Invest team. They’ll be able to answer questions you might have, talk you through different property investing strategies and maybe even help you get started with buy-to-let deals at a discount that you won’t find anywhere else.